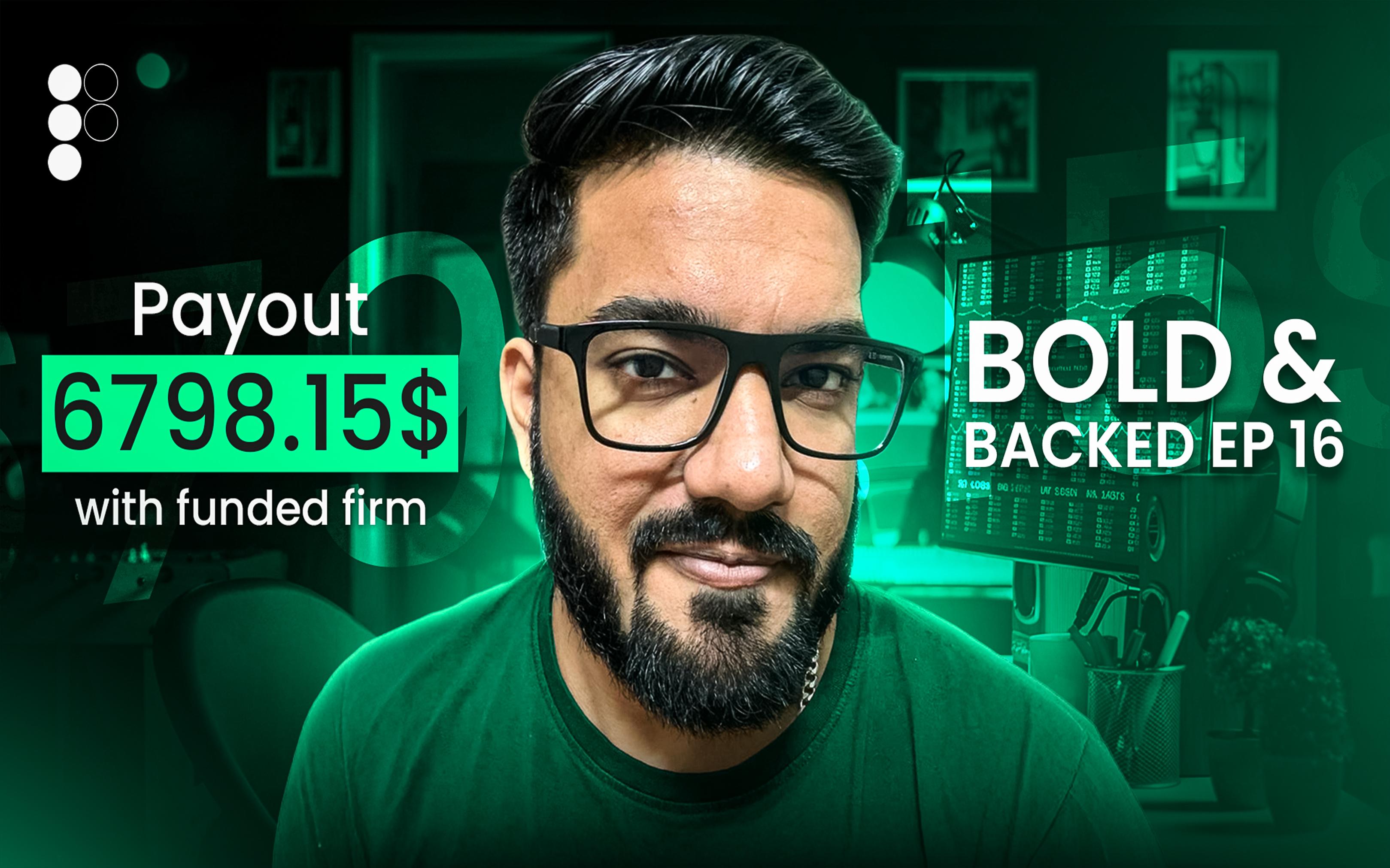

Success in funded trading doesn’t happen overnight—it’s built through discipline, patience, and strict risk management. Pulkit R Awasthi’s $6,798 payout story is a powerful example of how consistent execution and the right mindset can turn trading skills into real payouts. This case study highlights Pulkit’s trading journey, strategy, and the key lessons every trader can learn.

Who Is Pulkit R Awasthi?

Pulkit R Awasthi is a disciplined trader who focused on mastering risk control rather than chasing quick profits. Like many traders, he faced challenges early on, but his commitment to structured trading eventually led him to achieve a successful payout with FundedFirm.

His story proves that funded trading rewards consistency, not impulsive decision-making.

The Strategy Behind Pulkit R Awasthi’s $6,798 Payout Story

The foundation of Pulkit R Awasthi’s $6,798 payout story lies in a simple but effective trading approach. Instead of overtrading, Pulkit focused on:

-

High-probability trade setups

-

Clear entry and exit rules

-

Strict stop-loss placement

-

Controlled position sizing

By maintaining a favorable risk-to-reward ratio, he ensured that losses remained small while profits compounded steadily.

Risk Management: The Key to Consistency

One of the most important factors behind Pulkit’s success was disciplined risk management. He followed predefined risk limits on every trade and avoided emotional trading decisions.

Key risk principles he followed:

-

Risking a small percentage per trade

-

Avoiding revenge trading

-

Respecting daily loss limits

This approach allowed him to protect his funded account and grow it steadily.

Trading Psychology and Discipline

Trading psychology played a major role in Pulkit R Awasthi’s $6,798 payout story. Pulkit stayed patient during drawdowns and never deviated from his trading plan.

Instead of reacting to short-term market noise, he focused on long-term consistency—an essential habit for funded traders.

How FundedFirm Supported Pulkit’s Success

FundedFirm provided Pulkit with a structured trading environment that encouraged discipline and professional behavior. With clear rules, transparent payout systems, and reliable trading conditions, he was able to focus solely on execution and strategy.

Funded trading allowed Pulkit to scale his performance without risking large personal capital.

Lessons Traders Can Learn from Pulkit R Awasthi’s Journey

Pulkit’s story offers valuable insights for aspiring funded traders:

-

Consistency matters more than big wins

-

Risk management is non-negotiable

-

Emotional control is essential

-

A funded account rewards discipline

Pulkit R Awasthi’s $6,798 payout story is proof that following the rules leads to real rewards.

Final Thoughts

Pulkit R Awasthi’s $6,798 payout story is an inspiring example of how structured trading and discipline can produce consistent results. For traders aiming to succeed in funded trading, his journey highlights the importance of patience, strategy, and risk control.

If you’re serious about building a long-term trading career, learn from success stories like Pulkit’s and focus on trading with discipline—not emotion.