As businesses grow, managing accounts receivable (AR) becomes more complex. Invoices increase, payment cycles change, customer disputes become more frequent, and financial data needs to be updated across multiple systems in real time. To handle these challenges, more companies are choosing offshore AR services that seamlessly integrate with their ERP and accounting systems.

Today, advanced integration is the backbone of efficient AR management. The right offshore team ensures that your financial data flows smoothly from one system to another—accurately, securely, and without disruptions. This is exactly where professional offshore accounts receivable services provide exceptional value to modern organizations.

In this article, we’ll explore how offshore AR teams work with leading ERPs, what integration really looks like in practice, and why it has become a game-changer for US businesses.

Why Integration Matters in Accounts Receivable Management

Before diving into how integration works, it’s important to understand why it matters so much.

Every AR process—from invoice generation to payment posting—depends on real-time, accurate data. When systems don’t talk to each other, businesses face:

-

Delayed cash flow updates

-

Duplicate entries

-

Manual errors

-

Missing or outdated customer records

-

Slower reconciliation

-

Longer DSO (Days Sales Outstanding)

Integration solves these problems by creating a unified financial ecosystem. Offshore AR teams ensure that data flows seamlessly between systems so your business remains fast, scalable, and compliant.

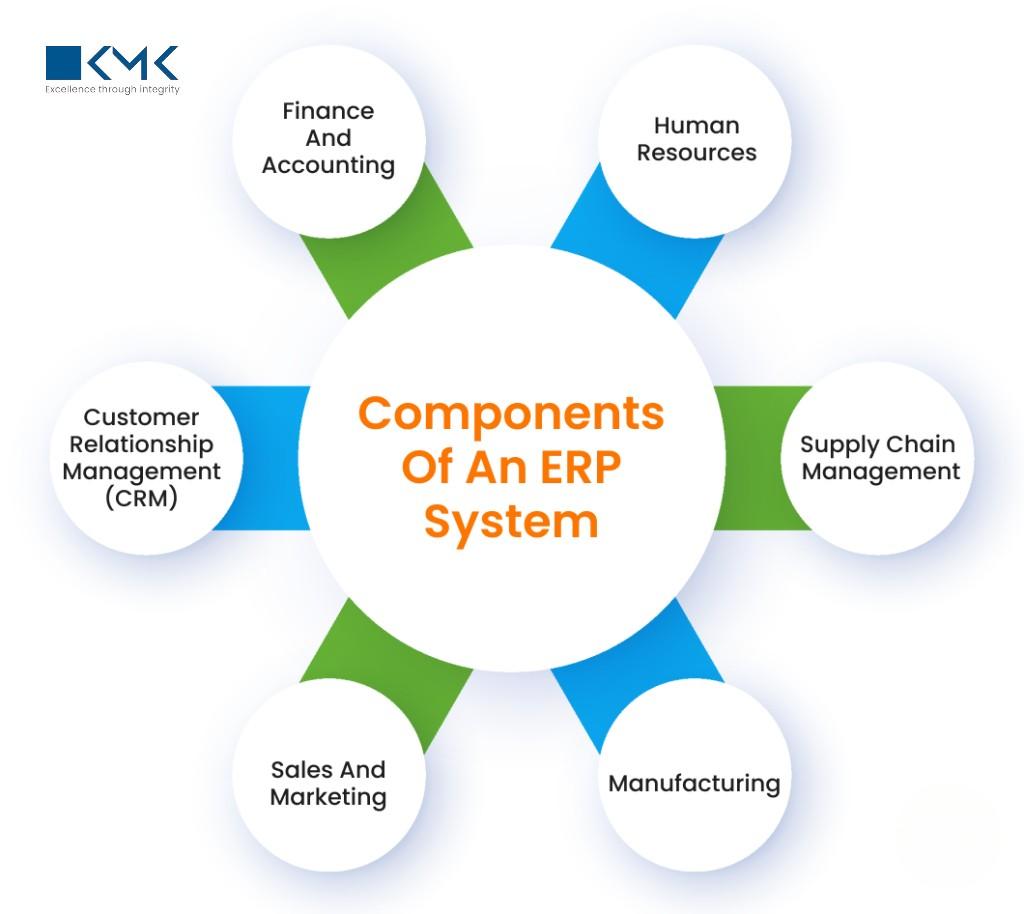

Common Systems Offshore AR Teams Integrate With

Most businesses use a combination of tools—not just one platform—to manage their finance function. Offshore AR specialists are trained to work with all major ERP and accounting systems, including:

-

QuickBooks Online / QuickBooks Enterprise

-

NetSuite ERP

-

SAP

-

Microsoft Dynamics 365

-

Xero

-

Sage Intacct

-

Oracle ERP Cloud

-

Zoho Books

-

FreshBooks

-

Bill.com

-

Stripe & PayPal (for payment tracking)

-

CRM tools like Salesforce, HubSpot, Zoho CRM

This ensures businesses can outsource AR seamlessly without changing their existing technology stack.

How Offshore AR Services Integrate With ERPs and Accounting Systems

Integration isn’t just about connecting apps—it’s about creating a consistent workflow where data flows smoothly across all financial processes. Here’s how offshore AR teams make it happen:

1. Understanding Your Current Financial Infrastructure

Every business has a different setup. The offshore team begins by analyzing:

-

Your ERP

-

Accounting software

-

Billing systems

-

Payment gateways

-

CRM tools

-

Reporting dashboards

They map how information flows between these systems and identify bottlenecks, duplication issues, or gaps.

2. Setting Up API-Based Integrations

Most modern accounting and ERP platforms offer APIs that allow systems to communicate directly.

Offshore AR teams use APIs to integrate:

-

Invoice data

-

Payment records

-

Customer information

-

Credit memos

-

Adjustments

-

Dispute logs

-

Reconciliation updates

API integration ensures that updates in one system reflect accurately across all other connected systems.

3. Custom Automation Workflows

This is where offshore AR services create real value.

Depending on your AR process, the team configures automations such as:

-

Auto-sending invoices

-

Auto-reminders for overdue customers

-

Automatic payment posting

-

Automated reconciliation

-

Real-time DSO dashboards

-

Auto-logging disputes or credit requests

-

Workflow alerts for approvals

Automation reduces manual effort and minimizes errors, keeping your AR cycle fast and consistent.

4. Syncing Customer and Payment Data in Real Time

One of the biggest frustrations for US businesses is dealing with outdated information across multiple systems.

Offshore teams solve this with real-time syncing:

-

Customer details update across all connected tools

-

Payment tracking is instantaneous

-

Partial payments and adjustments sync automatically

-

AR aging reports reflect real-time status

This reduces reconciliation time and ensures your financial decision-making is based on accurate data.

5. Integrating Payment Gateways

Payment gateways such as Stripe, PayPal, Authorize.net, and Square often store payment details separately. Offshore AR teams integrate these gateways with your ERP to ensure:

-

Paid invoices get auto-closed

-

Fees are recorded correctly

-

Refunds sync into the system

-

Payment timestamps match your accounting records

This eliminates manual work during month-end close.

6. Deep Integration With CRM Tools

AR doesn’t operate in isolation—sales and customer service also rely on real-time financial data.

By integrating CRM platforms, offshore teams ensure:

-

Sales teams see invoice statuses

-

Customer service teams view payment history

-

Credit limits are updated in real time

-

Client communication remains aligned

This improves customer experience and reduces payment disputes.

7. Reporting and Dashboard Integration

Offshore AR specialists build dashboards that combine data from ERPs, CRMs, billing platforms, and payment gateways.

These dashboards provide visibility into:

-

Cash flow forecasts

-

Outstanding invoices

-

DSO trends

-

Payment behavior

-

Monthly collections

-

Dispute resolutions

-

High-risk accounts

With integrated reporting, businesses make smarter and faster financial decisions.

Benefits of Offshore AR Integration for US Businesses

Proper integration provides multiple advantages that directly impact growth, profitability, and efficiency.

1. Faster Cash Flow and Reduced DSO

Automation speeds up collections, enabling businesses to get paid faster.

2. Better Accuracy and Fewer Manual Errors

Real-time syncing eliminates duplicate entries, incorrect postings, and missing data.

3. Scalability Without Additional Hiring

Offshore teams handle large invoice volumes without increasing headcount or cost.

4. Improved Compliance and Audit Readiness

Integrated systems maintain clean financial records and complete audit trails.

5. Stronger Decision-Making With Real-Time Visibility

Leaders get 24/7 access to up-to-date AR data through integrated dashboards.

Answering the Questions Users Ask Most

Do I need to change my existing system to outsource AR?

No—offshore teams work with your current ERP and accounting tools.

Is integration secure?

Yes—integrations use encryption, MFA, access controls, and secure APIs.

Can offshore teams manage high invoice volumes?

Absolutely—offshoring provides scalability without extra hiring.

Will I still control my data?

Yes—you maintain full ownership and access through the cloud.

Final Thoughts

Today’s businesses rely on speed, accuracy, and automation to stay competitive. Offshore AR services make this possible by integrating seamlessly with ERP and accounting systems—creating a unified, real-time financial workflow. When done right, integration improves collections, reduces errors, enhances financial visibility, and supports business growth at scale.

Partnering with the right provider for offshore accounts receivable services ensures your systems stay connected, efficient, and future-ready—no matter how fast your business grows.