Market Overview:

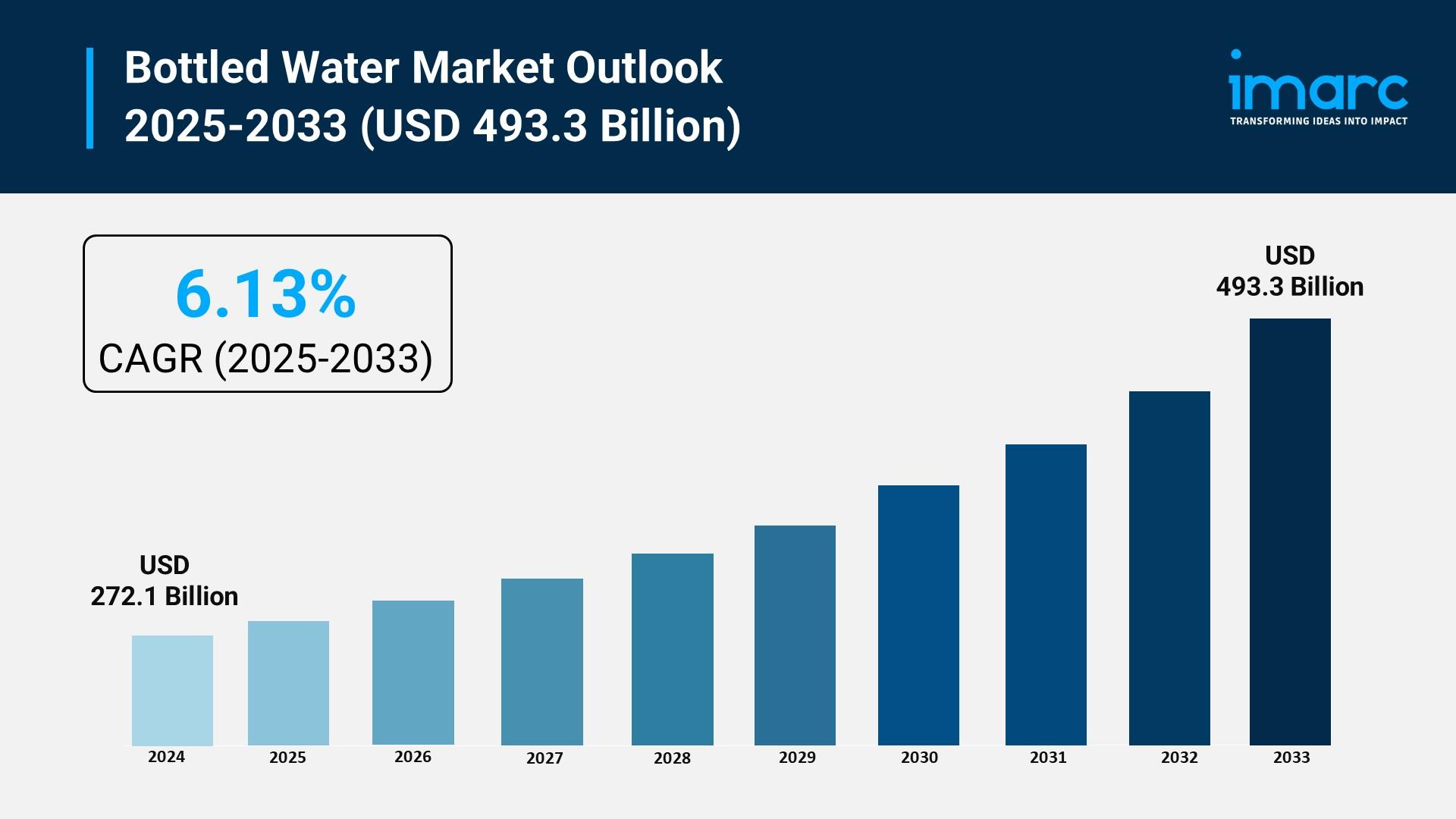

The bottled water market is experiencing rapid growth, driven by rising health consciousness among consumers, urbanization and on-the-go lifestyles, and concerns over tap water quality. According to IMARC Group’s latest research publication, “Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type, and Region, 2025-2033”, the global bottled water market size was valued at USD 272.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 493.3 Billion by 2033, exhibiting a CAGR of 6.13% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/bottled-water-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Bottled Water Market

- Rising Health Consciousness Among Consumers

People are increasingly prioritizing health, and the bottled water industry is reaping the benefits as consumers swap sugary drinks for healthier options. This shift is driven by growing awareness of the risks tied to high-calorie beverages, like obesity and diabetes. In the U.S., bottled water has overtaken carbonated soft drinks, with per capita consumption hitting 46.4 gallons compared to 34.4 gallons for soft drinks. Brands like Nestlé’s Pure Life and Coca-Cola’s Dasani are capitalizing on this by promoting purified and mineral-enhanced waters as clean, calorie-free alternatives. Government campaigns, like those from the WHO emphasizing hydration, further fuel this trend. The bottled water industry also benefits from perceptions of safety and purity, especially in regions where tap water quality raises concerns, driving demand for reliable hydration options.

- Urbanization and On-the-Go Lifestyles

The fast-paced lives of urban dwellers are boosting the bottled water industry as convenience becomes a key purchase driver. With more people living in cities and juggling busy schedules, portable hydration solutions are in high demand. Bottled water’s availability in various sizes, from single-serve to family packs, caters to commuters, travelers, and fitness enthusiasts. In India, the Railway Catering and Tourism Corporation ramped up bottled water production to 357.7 million units to meet tourist demand. Major players like PepsiCo and Danone are investing in compact, eco-friendly packaging to appeal to this mobile market. Social media amplifies this trend, with 31 billion reaches highlighting bottled water’s role in active lifestyles, particularly among Millennials and Gen Z who value convenience and health.

- Concerns Over Tap Water Quality

Distrust in tap water safety is a major growth factor for the bottled water industry, especially in developing regions. About 2.2 billion people globally lack access to safe drinking water, pushing reliance on bottled water as a trusted alternative. In countries like India and Egypt, where waterborne diseases are a concern, consumers opt for bottled water for its perceived purity. Brands like Bisleri and Aquafina market their products as rigorously tested, meeting FDA and WHO standards. Governments are stepping in too—India’s push for clean water access indirectly supports bottled water sales in areas with poor infrastructure. This demand is evident in Asia-Pacific, which holds a 44.5% market share, driven by rising awareness and the need for safe hydration options.

Key Trends in the Bottled Water Market

- Functional and Fortified Waters

The bottled water industry is seeing a surge in functional waters infused with vitamins, minerals, and botanicals, appealing to health-focused consumers. These products promise benefits like better hydration, immune support, or mental clarity. For example, brands like Hint Water offer 16 fruit-infused flavors with no added sugar, gaining traction on social media with 232 million engagements. Adaptogens and nootropics, like ashwagandha or ginseng, are being added for stress relief and cognitive boosts. Nearly 1 in 3 consumers globally have upped their bottled water intake, partly due to these enhanced options. This trend aligns with wellness demands, with 59% of new product launches featuring flavored or functional waters, catering to those seeking more than just hydration.

- Sustainable Packaging Innovations

Eco-friendly packaging is reshaping the bottled water industry as consumers prioritize sustainability. Brands are moving away from single-use plastics toward recyclable PET, biodegradable materials, and aluminum cans. Coca-Cola’s Smartwater recently launched 12-ounce aluminum cans, blending convenience with environmental appeal. In Europe, 90% of consumers consider sustainability in purchase decisions, pushing companies like Nestlé to invest in bottle-to-bottle recycling programs. Social media buzz, with 31 billion reaches, highlights this shift, as brands showcase recycled packaging to attract eco-conscious buyers. Innovations like hybrid paper-plastic bottles are also emerging, reducing virgin plastic use. These efforts not only address environmental concerns but also build brand loyalty among younger consumers who value green practices.

- Premiumization and Luxury Branding

The bottled water industry is tapping into premiumization, with high-end brands like Evian and Fiji Water positioning their products as symbols of purity and exclusivity. This trend targets affluent consumers, especially in urban Asia-Pacific markets like China, where premium water sales are soaring due to rising disposable incomes. Specialized water menus in fine dining, featuring mineral and sparkling options, are becoming common, with 53% of European consumers choosing premium waters for their perceived quality. Social media plays a big role, with platforms like Pinterest driving engagement through water recipes and luxury branding. Companies are also launching unique flavors like yuzu or white peach to appeal to adventurous tastes, further elevating bottled water’s status as a lifestyle product.

Leading Companies Operating in the Global Bottled Water Industry:

- Bisleri International Pvt. Ltd.

- Danone S.A.

- Gerolsteiner Brunnen GmbH & Co. KG

- Nestle S.A.

- Nongfu Spring (Yangshengtang Co. Ltd.)

- Otsuka Pharmaceutical Co. Ltd.

- PepsiCo Inc.

- Primo Water Corporation

- Tata Consumer Products Limited

- The Coca-Cola Company

Bottled Water Market Report Segmentation:

By Product Type:

- Still

- Carbonated

- Flavored

- Mineral

Still bottled water dominates the market in 2024 with a 55.8% share, driven by health awareness and demand for hydration.

By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

Supermarkets and hypermarkets lead distribution with 59.4% market share in 2024, offering extensive variety and convenience for consumers.

Packaging Type:

- PET Bottles

- Metal Cans

- Others

PET bottles hold an 80.0% market share in 2024 due to their recyclability and availability in various sizes, enhancing environmental friendliness.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia-Pacific leads the bottled water market in 2024 with over 44.5% share, fueled by urbanization, rising incomes, and concerns over water-borne diseases.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302