In today’s competitive business landscape, organizations are constantly seeking ways to optimize operations, reduce costs, and enhance productivity. One of the most effective strategies finance teams are adopting is Accounts Payable Business Process Outsourcing (AP BPO). This comprehensive guide will walk you through everything you need to know about accounts payable outsourcing—from its benefits and challenges to implementation tips and vendor selection strategies.

What is Accounts Payable Business Process Outsourcing?

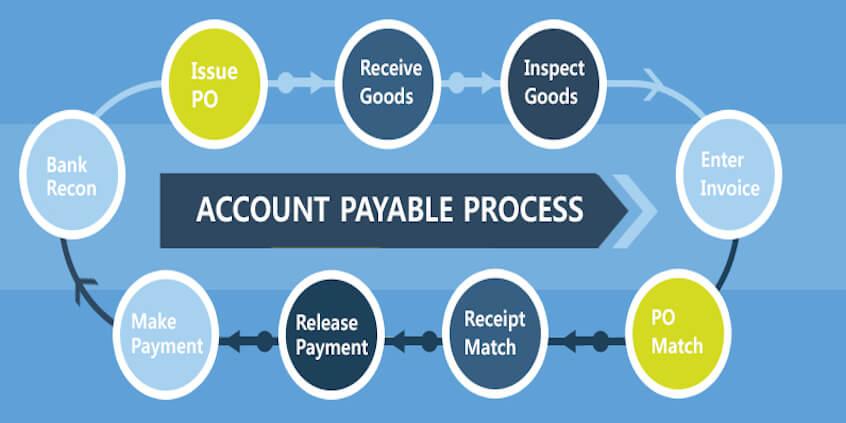

Accounts Payable Business Process Outsourcing involves contracting a third-party service provider to handle all or part of your accounts payable function. This includes tasks like invoice processing, vendor payments, reconciliation, and compliance reporting. By outsourcing these functions, businesses aim to improve efficiency, reduce operational overhead, and ensure more accurate and timely payments.

Why Companies Outsource Accounts Payable

Organizations of all sizes are realizing the strategic advantages of outsourcing their AP processes. Here are the key drivers:

1. Cost Savings

Maintaining an in-house AP department can be expensive due to staffing, training, technology, and infrastructure costs. Outsourcing shifts these responsibilities to the service provider, often at a significantly lower cost.

2. Access to Expertise

Outsourcing firms specialize in financial operations and maintain a team of professionals who are up to date with industry best practices, regulations, and technologies.

3. Scalability

Outsourced AP services are highly scalable, allowing businesses to easily adapt to changing volumes during peak seasons or periods of growth without increasing overhead.

4. Faster Processing Times

With established workflows and automation tools, AP outsourcing providers can often process invoices and payments faster, reducing late fees and improving vendor relationships.

5. Improved Compliance and Risk Management

Professional outsourcing partners implement stringent controls and maintain audit trails to ensure regulatory compliance, helping to minimize fraud and errors.

Core Services Included in AP BPO

Depending on the provider and service level, accounts payable BPO may include:

-

Invoice receipt and data entry

-

Purchase order (PO) matching

-

Non-PO invoice processing

-

Payment processing and scheduling

-

Vendor management and communication

-

Tax and regulatory compliance

-

Exception handling and issue resolution

-

Reporting and analytics

When Should You Consider Outsourcing Accounts Payable?

Outsourcing isn’t just for large enterprises. Small and mid-sized businesses can benefit, too. Consider AP outsourcing if:

-

Your finance team is overwhelmed by manual tasks

-

There are frequent errors or delays in payments

-

Your company is scaling and needs to process more invoices

-

You lack the technology to automate and track AP workflows

-

You want to focus internal resources on core business functions

Benefits of Accounts Payable Business Process Outsourcing

✅ Enhanced Operational Efficiency

Outsourcing streamlines the entire AP process, eliminating bottlenecks and improving cash flow management.

✅ Improved Accuracy and Fewer Errors

Experienced service providers use robust quality control checks and automation to minimize human error in data entry and payments.

✅ Better Vendor Relationships

Timely and accurate payments foster stronger vendor relationships and may even lead to better terms or discounts.

✅ Real-Time Visibility

Modern AP outsourcing partners offer dashboards and analytics that provide real-time insights into your accounts payable status.

✅ Focus on Core Competencies

Freeing your internal team from repetitive AP tasks allows them to focus on higher-value financial strategy and planning.

Challenges to Be Aware Of

While outsourcing offers numerous benefits, it’s important to be aware of potential challenges:

-

Loss of control: Handing over critical processes can lead to concerns about visibility and decision-making.

-

Data security: Financial data is sensitive. Make sure your provider has strict security protocols.

-

Integration issues: Systems integration between your ERP and the provider’s platform must be seamless.

-

Vendor dependency: Relying too heavily on one provider can introduce risks if service levels decline or the partnership ends.

A good outsourcing provider will address these challenges through service-level agreements (SLAs), transparent reporting, and secure technologies.

How to Choose the Right AP Outsourcing Partner

Selecting the right partner is crucial to the success of your outsourcing initiative. Here are some factors to consider:

1. Experience and Reputation

Look for providers with a solid track record in AP outsourcing, preferably within your industry.

2. Technology Capabilities

Ensure they use automation tools, OCR (optical character recognition), and dashboards that integrate well with your ERP or accounting software.

3. Security Standards

Ask about their data protection policies, compliance certifications (e.g., SOC 2, GDPR), and disaster recovery plans.

4. Scalability and Flexibility

Choose a partner that can adapt to your business’s changing needs without compromising service quality.

5. Client Support

A dedicated account manager and responsive support team are essential for maintaining smooth operations and resolving issues promptly.

Steps to Successfully Outsource Accounts Payable

-

Assess Your Current AP Process

Identify pain points, inefficiencies, and volume trends. -

Set Clear Goals

Define what you hope to achieve—cost savings, faster processing, better compliance, etc. -

Select the Right Partner

Conduct a thorough RFP process, evaluate multiple providers, and choose the one that best meets your needs. -

Develop a Transition Plan

Outline timelines, responsibilities, and communication plans for a smooth transition. -

Monitor and Optimize

Regularly review performance against SLAs, and make continuous improvements based on analytics and feedback.

Conclusion

Accounts Payable Business Process Outsourcing offers a strategic opportunity for businesses to streamline their financial operations, reduce costs, and improve accuracy and compliance. By partnering with the right provider, companies can transform their AP process from a manual, error-prone function into a streamlined, efficient, and scalable system. Whether you’re a small business looking to grow or a large enterprise aiming to optimize, AP BPO could be the key to unlocking greater financial agility and operational excellence.