Finance teams are at the core of every organization, managing vendor invoices, approvals, and payments that directly impact business cash flow. Traditional methods of handling accounts payable are time-consuming, error-prone, and expensive. Accounts payable automation offers a transformative solution by digitizing the entire AP cycle from invoice capture to payment execution making finance smarter, faster, and more reliable.

Automation is no longer just about efficiency; it’s about resilience. Companies adopting AP automation not only cut costs but also gain real-time insights into cash flow and strengthen vendor relationships.

Why Businesses Need Accounts Payable Automation

Manual accounts payable processes involve multiple stakeholders, paper invoices, and countless email follow-ups. These challenges create bottlenecks and increase risks such as fraud or missed payments. Common issues include:

-

Lost or duplicate invoices

-

Delayed approvals due to manual routing

-

High error rates in data entry

-

Poor visibility into pending liabilities

-

Increased operational costs

With accounts payable automation, companies move away from these inefficiencies toward intelligent, digital-first workflows.

How Accounts Payable Automation Works

Accounts payable automation integrates technologies like artificial intelligence, machine learning, and workflow automation. A typical AP automation workflow includes:

-

Invoice Capture: Invoices are received digitally or scanned for processing.

-

Data Extraction: Intelligent software extracts relevant data fields accurately.

-

Invoice Matching: Automated three-way matching with purchase orders and receipts.

-

Approval Workflow: Digital routing to approvers with instant notifications.

-

Payment Processing: Scheduled, secure payments to vendors.

-

Analytics & Reporting: Dashboards provide real-time insights into cash flow.

By eliminating manual steps, finance teams can focus on strategy rather than repetitive data entry.

Top Benefits of Accounts Payable Automation

-

Reduced Costs: Significant savings by cutting manual work.

-

Faster Processing: Shorter invoice cycle times.

-

Accuracy: AI-powered tools minimize human errors.

-

Compliance: Built-in audit trails for better regulatory adherence.

-

Vendor Trust: On-time payments strengthen relationships.

-

Scalability: Easily handles increasing invoice volumes.

Industries Benefiting from Accounts Payable Automation

Accounts payable automation is widely adopted across industries:

-

Retail & E-commerce: Manage high invoice volumes seamlessly.

-

Healthcare: Ensure compliance while processing critical supplier payments.

-

Manufacturing: Improve supplier coordination and cost efficiency.

-

Hospitality & Travel: Handle multi-location payments effectively.

-

Finance & CPA Firms: Enable faster reconciliations and audits.

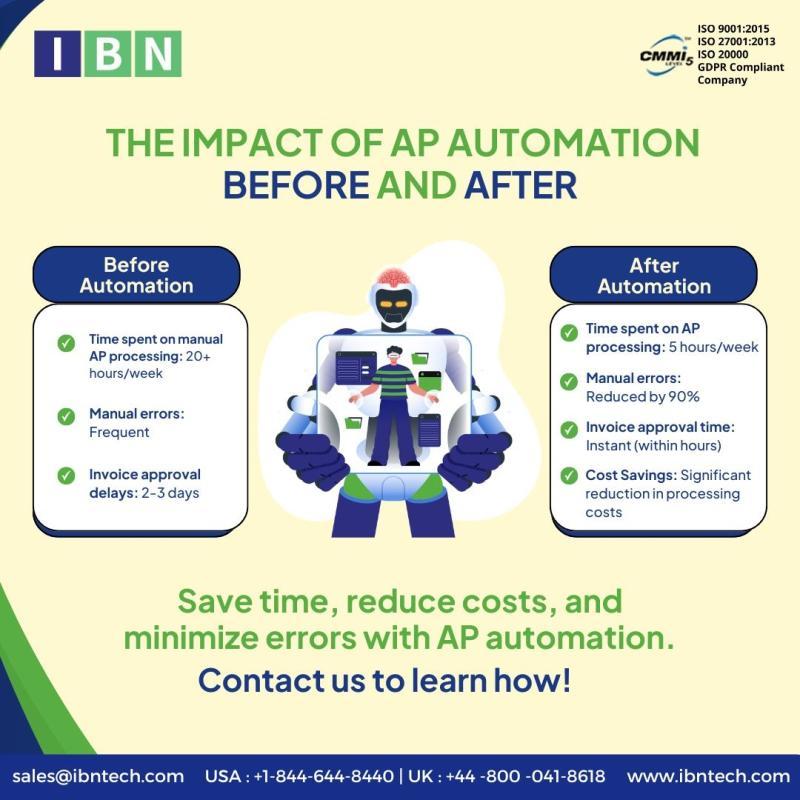

Manual vs. Automated Accounts Payable

| Manual AP | Automated AP |

|---|---|

| Paper invoices, prone to loss | Digital, centralized storage |

| Slow approval cycles | Instant electronic routing |

| High processing costs | Reduced costs through automation |

| Limited visibility | Real-time dashboards and analytics |

| High fraud risk | Automated controls and audit trails |

Building the Case for Accounts Payable Automation

The ROI of accounts payable automation goes beyond cost reduction. Businesses also benefit from:

-

Faster month-end closing cycles

-

Fewer late payment penalties

-

Improved working capital optimization

-

Enhanced accuracy in financial reporting

For CFOs, the ability to access real-time data is a key driver for investing in automation.

IBN Technologies: Expertise in Accounts Payable Automation

IBN Technologies delivers tailored accounts payable automation services that help businesses transition from manual processes to intelligent digital workflows. With expertise across industries like real estate, healthcare, IT, and manufacturing, IBN ensures clients achieve:

-

Streamlined invoice management

-

AI-powered invoice capture and processing

-

Cloud-based secure solutions

-

Scalable platforms for growing businesses

IBN acts as a trusted partner for organizations seeking a smooth and effective automation journey.

Conclusion: The Future of Accounts Payable Automation

In today’s competitive landscape, organizations cannot rely on outdated manual AP processes. Accounts payable automation has become a strategic necessity to ensure efficiency, accuracy, and compliance. By adopting automation, businesses not only save costs but also empower finance teams with insights that drive better decision-making.