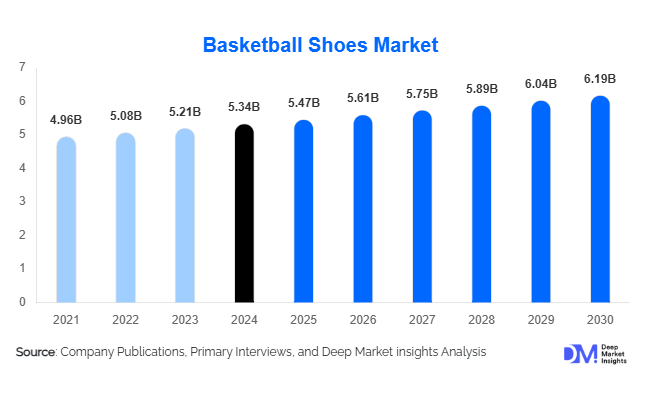

According to deep market insights, the global basketball shoes market, valued at USD 5.34 billion in 2024, is set to grow steadily from USD 5.47 billion in 2025 to USD 6.19 billion by 2030, registering a compound annual growth rate (CAGR) of 2.5% during the forecast period, according to the latest industry analysis. This growth is driven by the increasing global participation in basketball, high-profile athlete endorsements, and the crossover of basketball footwear into mainstream fashion and sneaker culture.

Market Dynamics

Basketball shoes remain a cornerstone of both athletic performance and lifestyle expression. With participation in basketball continuing to expand worldwide—FIBA estimates more than 450 million people actively engage in the sport—demand for specialized footwear is growing across professional, amateur, and recreational levels. Youth participation is a key driver, growing at 6% annually, creating a robust pipeline of future consumers.

Athlete endorsements continue to shape the industry, with signature lines from NBA superstars such as LeBron James, Stephen Curry, Giannis Antetokounmpo, and Ja Morant topping seasonal sales charts. This synergy between sports icons and footwear brands generates loyalty, consumer aspiration, and significant social media engagement, strengthening brand equity in a competitive market.

Market Trends

Performance innovation remains central to the basketball shoes segment. Brands are investing in hyper-engineered designs incorporating lightweight mesh, carbon fiber plates, and responsive foam midsoles to deliver maximum speed, grip, and support. For instance, Nike’s February 2025 launch of the Zoom GT Hustle 2 featured full-length Zoom Air Strobel cushioning paired with React foam, setting new benchmarks for elite responsiveness.

Equally important is the fusion of sport and style. Basketball footwear has firmly entrenched itself in global sneaker culture, transcending the court to dominate streetwear. Collaborations with designers, musicians, and cultural icons are increasingly common. Adidas’ March 2025 partnership with Japanese designer Nigo for the limited-edition “Forum Streetball” capsule sold out within minutes, underscoring the powerful blend of exclusivity, design, and cultural resonance.

Opportunities and Challenges

The rise of women’s basketball presents significant untapped opportunities. With growing visibility of leagues such as the WNBA and FIBA tournaments, performance footwear tailored to female athletes is gaining traction. Puma’s April 2025 launch of Stewie 2 Edge, designed in collaboration with WNBA star Breanna Stewart, reflects this shift toward gender-inclusive product lines.

At the same time, digital-first retail strategies are reshaping how consumers purchase basketball shoes. E-commerce, AR try-ons, sneaker apps, and direct-to-consumer (D2C) platforms enable brands to engage consumers with personalized offerings. Customization, from build-your-own colorways to biomechanically optimized insoles, has become a sought-after feature, especially among Gen Z and Millennial buyers seeking exclusivity and self-expression.

However, the industry continues to face challenges from high pricing and counterfeiting. Premium models priced between USD 150 and USD 300 limit accessibility in emerging markets, where knockoffs and grey-market sales undermine official distribution channels. Brands are investing in authentication technology, sustainable materials, and mid-tier product offerings to bridge this gap and protect market share.

Regional Insights

North America remains the largest market, driven by NBA culture, retro Jordan releases, and strong resale platforms. Sustainability trends, such as vegan leather uppers and recyclable midsoles, are gaining momentum among eco-conscious consumers.

Asia-Pacific is the fastest-growing region, led by China, Japan, and South Korea, where sneaker culture, NBA influence, and mobile-first retail dominate. Digital drops, localized campaigns, and influencer-led marketing are highly effective in capturing this young, fashion-conscious demographic.

Europe continues to thrive on sneaker culture, with markets like Germany, France, and the UK blending basketball participation with urban fashion. Regulatory emphasis on sustainable materials also shapes brand strategies in the region.

Meanwhile, Latin America and Middle East & Africa (MEA) are emerging frontiers. Countries like Brazil, Mexico, and Nigeria are seeing basketball grow in popularity, driven by urban youth culture and increased broadcast exposure. Competitive pricing and localized designs will be crucial for expansion in these regions.

Competitive Landscape

The global basketball shoes market is highly consolidated, led by Nike, which continues to dominate through its Jordan Brand, SNKRS platform, and deep athlete roster. In January 2025, Jordan Brand crossed USD 6 billion in global annual revenue, marking a new milestone. Adidas, Puma, Under Armour, Anta, Li-Ning, and Peak remain key challengers, leveraging regional endorsements, performance innovations, and cross-cultural collaborations.

Recent developments further illustrate competitive intensity. In March 2025, Under Armour launched the HOVR Forge, its first 3D-printed basketball shoe, advancing material science for elite athletes. In April 2025, Anta secured NBA MVP Giannis Antetokounmpo in a landmark global endorsement deal, signaling its intent to expand beyond Asia into Western markets.

Outlook

As basketball continues to grow globally—both as a sport and a lifestyle—the basketball shoes market is poised for steady expansion. The interplay of innovation, cultural influence, and athlete-brand partnerships ensures the category remains dynamic and resilient. With sustainability, customization, and digital-first strategies shaping the next phase of growth, leading brands are well-positioned to capture evolving consumer demand.