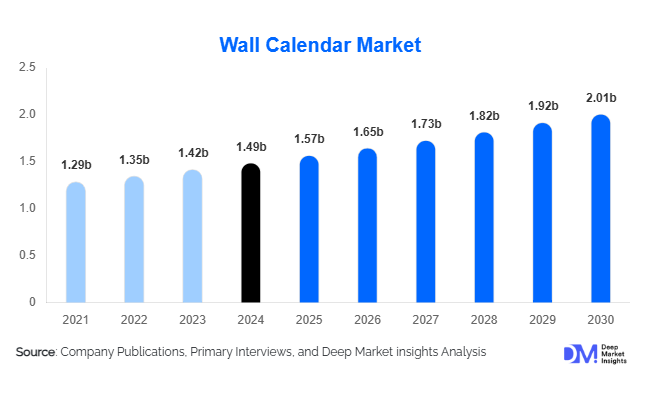

According to the deep market insights the global wall calendar market continues to thrive despite the digital shift, with new research projecting steady growth from USD 1.49 billion in 2024 to USD 2.01 billion by 2030, at a compound annual growth rate (CAGR) of 5.11% between 2025 and 2030. The enduring cultural significance of wall calendars, combined with corporate branding strategies, personalization, and eco-friendly innovations, are fueling this expansion.

Personalization and Emotional Connection Drive Demand

Wall calendars are no longer just functional planners—they have evolved into highly personalized keepsakes. The ability to customize with family photos, travel memories, or pet portraits has captured strong consumer interest, especially among parents, pet lovers, and travelers. This personal touch adds emotional value, transforming calendars into sentimental products that go beyond basic organization.

Brands are also capitalizing on personalization trends by offering user-friendly platforms and print-on-demand services. From marking special dates to selecting niche themes, these innovations allow consumers to create calendars that reflect individual lifestyles and identities.

Corporate Branding Strengthens Market Growth

Corporate gifting remains a cornerstone of the market, reinforcing steady demand. Wall calendars continue to serve as cost-effective, high-visibility promotional tools across industries such as healthcare, real estate, and education. According to a 2024 study from ASI Research, promotional wall calendars generate 673 brand impressions per recipient annually, with 62% of recipients keeping them for a full year.

This long-lasting exposure makes wall calendars one of the most impactful promotional items for businesses, ensuring year-round brand presence in homes and offices.

E-Commerce and Online Retail Dominate Distribution

Online retail channels are now the leading sales avenue for wall calendars, supported by platforms like Amazon, Vistaprint, and Snapfish. Consumers enjoy real-time previews, easy customization, and doorstep delivery, while small businesses benefit from lower costs and broader reach. Social media and influencer-driven marketing have further boosted niche sales, helping creators target micro-communities with themed calendars ranging from fitness and education to lifestyle and humor.

Regional Growth Insights

-

North America remains a mature yet resilient market, fueled by a strong gifting culture, fundraising initiatives, and corporate branding. Personalized calendars continue to thrive through platforms like Shutterfly.

-

Europe shows high demand for scenic, art-inspired, and eco-friendly calendars, particularly among older demographics and environmentally conscious buyers.

-

Asia-Pacific is a fast-growing region, where cultural traditions, religious festivals, and seasonal gifting sustain demand. India, China, and Japan lead the region with calendars that incorporate local languages, auspicious dates, and minimalist designs.

-

Latin America and the Middle East & Africa rely heavily on cultural, religious, and community-based calendars. In these regions, calendars are widely distributed by churches, businesses, and NGOs, ensuring continued relevance despite digital adoption.

Latest Market Trends

The industry is undergoing significant transformation with the rise of “Phygital” calendars—hybrid products that merge physical appeal with digital interactivity. Featuring QR codes and links to videos, websites, or appointment tools, these calendars redefine user engagement and brand recall. Companies like PromoCalendarsDirect have already launched interactive calendars, turning traditional formats into dynamic marketing assets.

Another key trend is the shift toward minimalistic and timeless designs. Consumers increasingly favor clean layouts, muted colors, and legible typography that align with modern interiors and wellness-driven lifestyles. This design philosophy reflects a growing preference for intentional living, calmness, and aesthetic harmony.

Opportunities in Sustainability

Eco-conscious consumers are driving strong demand for wall calendars made from recycled paper, bamboo, and hemp, printed with soy-based inks. Companies like JustCalendar are pioneering in this segment, offering biodegradable, carbon-conscious products that combine sustainability with visual appeal. With rising awareness of climate impact, sustainable calendars present an opportunity for brands to strengthen loyalty while reducing environmental footprints.

Market Challenges

While the market is expanding, challenges remain. The dominance of digital calendars like Google Calendar and Apple Calendar continues to reduce reliance on physical planners, especially among younger consumers. Additionally, the highly seasonal nature of wall calendar sales—peaking between October and January—creates inventory risks and limits year-round revenue opportunities.

Competitive Landscape

Key players in the wall calendar market include Ad-A-Day, American Calendar, Alliance Franchise Brands, Cavallini Papers & Co., House of Doolittle, and ArtfulDragon.com. These companies are leveraging creativity, B2B customization, and eco-friendly production methods to strengthen their global presence.

Recent industry developments highlight this momentum:

-

October 2024 – Anderson Design Group released 14 new wall calendars featuring vintage poster art alongside a “Build Your Own” personalization platform.

-

October 2024 – Promo Direct unveiled a new eco-friendly calendar line using recycled paper and soy-based inks for corporate branding.

-

March 2025 – Skylight introduced a smart touchscreen wall calendar syncing with Google, Outlook, and Apple, signaling competition from digital alternatives.

Conclusion

Despite challenges from digital adoption, the wall calendar industry is set for steady growth through 2030, fueled by personalization, cultural traditions, corporate branding, and eco-conscious innovations. By blending tradition with technology, the market continues to reinvent itself as a timeless yet evolving product category.