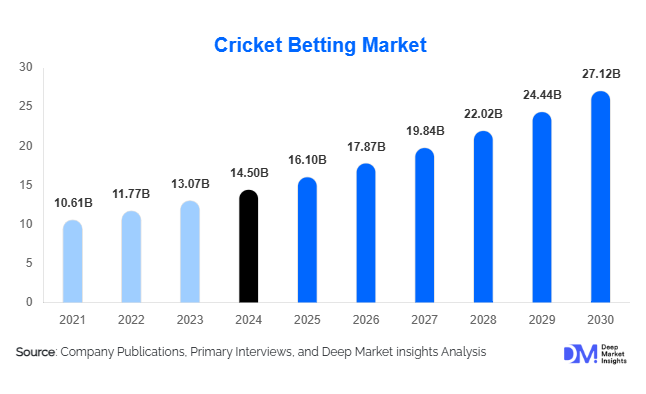

According to deep market insights, the global cricket betting market is entering a transformative phase, projected to grow from USD 16.10 billion in 2025 to USD 27.12 billion by 2030, at an impressive CAGR of 11%. According to new industry insights, this growth is fueled by technological innovation, rapid digital adoption, favorable regulatory reforms, and the emerging popularity of fast-paced cricket formats such as T20s and regional leagues.

Rising Popularity of In-Play and Mobile Betting

Live, in-play betting has emerged as the most dominant segment in the cricket wagering market, particularly during high-profile tournaments like the Indian Premier League (IPL) and international T20 matches. This interactive format allows users to place bets in real time on dynamic events such as wickets, boundaries, and player performances, significantly boosting engagement and retention.

Mobile applications have also cemented their place as the preferred betting platform, supported by growing smartphone penetration and faster internet access. Features such as one-click betting, push notifications, instant deposits, and integrated live streaming are transforming user experience. During the 2025 IPL season, several apps including DreamBet and CrickMela recorded record-breaking downloads, underscoring mobile betting's dominance in cricket markets.

Key Market Insights

-

Asia-Pacific Leads : Asia-Pacific continues to dominate cricket betting globally, led by India's cricket-obsessed fan base, accessible mobile platforms, and expanding digital payments infrastructure.

-

Europe as Fastest-Growing : Europe is experiencing rapid growth, driven by the UK's established betting culture and rising interest in markets like Germany and the Netherlands through diaspora communities.

-

Recreational Bettors at the Core : A large share of cricket betting users are recreational bettors, who are drawn to user-friendly platforms, bonus offers, and the thrill of betting during major events.

Technology Driving Growth: AI & Data Infrastructure

Artificial intelligence and advanced data analytics are reshaping cricket betting platforms. Industry leaders such as Bet365, Parimatch, and DraftKings are increasingly relying on predictive analytics to generate dynamic, personalized odds and ball-by-ball betting opportunities. AI integration not only enhances accuracy but also strengthens fraud detection by identifying unusual betting patterns.

At the backend, robust data infrastructure is becoming critical. On June 24, 2025, Data Sports Group demonstrated the power of real-time cricket APIs, offering ultra-low latency feeds that deliver every run, wicket, and weather update seamlessly. Such infrastructure ensures platforms scale effectively during high-traffic events like the IPL, providing reliable and transparent betting experiences.

Legalization & Regulatory Progress

Governments worldwide are increasingly formalizing online betting frameworks, supporting regulated growth in cricket wagering. The UK and Australia continue to lead with mature, transparent systems, while Indian states such as Sikkim and Nagaland are issuing online betting licenses to encourage lawful participation. These reforms attract global operators to local markets and increase user trust by embedding responsible gambling safeguards.

Restraints: Legal Ambiguity & Illegal Platforms

Despite significant progress, challenges remain. In countries like India, fragmented state-level laws create uncertainty for investors and operators. Additionally, the rise of illegal offshore betting platforms undermines credibility and user safety, contributing to billions in untaxed revenues while exposing bettors to risks such as rigged odds and identity theft. Combating these platforms is critical to sustaining regulated growth.

Opportunities: New Leagues & Data Providers

Emerging cricket formats and specialized data providers are unlocking new market opportunities. Regional leagues such as the Tamil Nadu Premier League, Abu Dhabi T10, and South Africa's SA20 are driving betting demand beyond traditional ICC events. Meanwhile, sports data firms are expanding their cricket coverage to thousands of monthly matches, helping operators improve engagement with localized odds, in-depth statistics, and live visuals.

Key Players & Recent Developments

The global market is led by established operators including Bet365, Parimatch, 1xBet, Dafabet, Betway, Stake, LeoVegas, 10CRIC, and Unibet .

-

In August 2025 , Bet365 expanded its US footprint by launching its sportsbook in Kansas, after successful entries in Illinois and Tennessee.

-

In April 2025 , the European Cricket Network named 1xBet as its exclusive betting partner for over 1,000 matches in the European Cricket Series and Championships.

-

In February 2025 , Innosoft Group unveiled a next-generation IPL betting platform featuring AI-driven insights, blockchain security, and multi-currency support.

-

In June 2024 , Stats Perform secured extended exclusive rights to ICC's official ball-by-ball data and streaming until 2027, enabling richer and more reliable betting products globally.

Outlook

With cricket's rising global profile, particularly through T20s and innovative regional tournaments, the betting market is set for sustained expansion. Enhanced backend systems, AI-powered personalization, and regulatory support will continue to fuel growth while reinforcing transparency and responsible gambling.

The industry's future lies in capturing recreational bettors through seamless mobile-first experiences, expanding coverage to new leagues, and leveraging real-time analytics to deliver interactive, secure, and engaging betting ecosystems. By 2030, cricket betting is expected to establish itself as a core pillar of global sports wagering, cementing its position alongside football and basketball in the digital betting economy.