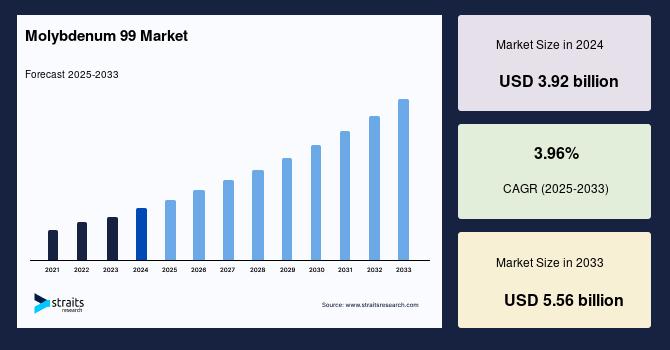

The global Molybdenum 99 Market size was valued at USD 3.92 billion in 2024 and is projected to grow from USD 4.07 billion in 2025 to USD 5.56 billion by 2033, exhibiting a CAGR of 3.96% during the forecast period (2025-2033).

Now, let’s dig deeper what’s molybdenum-99 used for, why is its supply fragile, and where is the market heading?

What is molybdenum-99 used for in real-world healthcare?

molybdenum-99 is the parent isotope of technetium-99m (Tc-99m), which is used in over 80% of all nuclear medicine diagnostic scans that’s millions of procedures every year.

Common diagnostic uses:

-

Cardiac stress tests

-

Bone scans for cancer

-

Kidney and thyroid imaging

-

Brain and lung diagnostics

Real-world example:

A heart patient might receive a Tc-99m scan to assess blood flow and detect blocked arteries non-invasively and with quick turnaround.

So, without molybdenum-99 , much of modern diagnostic imaging simply wouldn’t happen.

Request a sample report @ https://straitsresearch.com/report/global-molybdenum-99-market/request-sample

Why is molybdenum-99 supply considered unstable?

Because of a small number of aging nuclear reactors that produce it, mainly in Canada, South Africa, the Netherlands, Belgium, and Australia. Many of these facilities are decades old.

Top challenges:

-

Aging infrastructure and reactor shutdowns

-

Dependence on government-funded facilities

-

Geopolitical risks and logistical delays

-

Shift away from HEU, requiring new production methods

When one reactor goes offline even temporarily it can disrupt global supply.

What alternatives are being explored to produce molybdenum-99 ?

As demand for Tc-99m stays high, there's intense focus on diversifying molybdenum-99 production and reducing reliance on reactors and HEU.

Leading alternative methods:

-

Cyclotron-based production of Tc-99m (bypasses molybdenum-99 )

-

Accelerator-based production using low-enriched uranium

-

Neutron capture methods (less efficient, but safer)

-

Solid target irradiation systems (e.g., used by NorthStar Medical)

These methods are greener, scalable, and non-weapons-grade, which aligns with international nuclear nonproliferation goals.

Who are the major players in the global molybdenum-99 market?

Key producers and innovators:

-

NTP Radioisotopes (South Africa)

-

ANSTO (Australia)

-

Curium Pharma (Europe)

-

NorthStar Medical Radioisotopes (USA – accelerator-based)

-

BWXT Medical (USA – ramping up LEU-based production)

-

SHINE Technologies (USA – next-gen fusion-based production)

North America is pushing hard for domestic, reactor-free solutions to stabilize supply and reduce dependency on imports.How big is the molybdenum-99 market and where is it heading?

| Year | Estimated Market Size |

|---|---|

| 2022 | $475 million |

| 2025 | $550 million |

| 2030 | $725 million (projected) |

Growth factors:

-

Rising diagnostic imaging demand, especially in aging populations

-

Growing nuclear medicine infrastructure in Asia-Pacific and Latin America

-

Emergence of private-sector producers filling supply gaps

-

Government incentives for non-HEU production

Constraint: The pace of market growth is directly tied to production stability and regulatory approvals.

What are the pros and cons of current molybdenum-99 production models?

| Factor | Traditional Reactor-Based | Emerging Non-Reactor Methods |

|---|---|---|

| Production Scale | High | Moderate (but growing) |

| Supply Stability | Low (reactor downtime) | High (modular, scalable) |

| Environmental Impact | Higher (waste, HEU) | Lower (LEU, accelerator-based) |

| Cost Efficiency | Currently cheaper | Becoming cost-competitive |

| Regulatory Hurdles | Already established | Requires new approvals |

Is there a shortage of molybdenum-99 right now?

Intermittent shortages still happen, especially when reactors go offline unexpectedly or scheduled maintenance overlaps.

However, the situation is improving thanks to:

-

New players like NorthStar and SHINE

-

US Department of Energy funding for domestic production

-

Better supply chain coordination

Still, the market remains vulnerable until more non-reactor methods are fully scaled.

FAQs: Global Molybdenum-99 Market

1. What is the difference between molybdenum-99 and Tc-99m?

molybdenum-99 is the precursor isotope that decays into technetium-99m, which is used directly in medical scans.

2. Why is there a push to stop using HEU for molybdenum-99 production?

HEU (highly enriched uranium) can be repurposed for nuclear weapons, making it a security risk. LEU (low-enriched) is much safer and non-proliferative.

3. Can we make molybdenum-99 without nuclear reactors?

Yes. New accelerator and cyclotron-based systems are proving successful and are already producing limited quantities of molybdenum-99 and Tc-99m.

4. How long can Tc-99m be used after it’s produced?

Tc-99m has a half-life of only 6 hours, which means it must be used within a day logistics are critical.

5. Which countries dominate molybdenum-99 production today?

Historically: South Africa, Australia, and Europe

Emerging: United States and Canada are increasing domestic production.

6. Will molybdenum-99 be replaced entirely by alternative isotopes?

Unlikely in the near term. Tc-99m remains unmatched in cost, effectiveness, and safety for nuclear imaging, so molybdenum-99 will stay essential.

7. Is the molybdenum-99 market open to private investment?

Yes. In fact, private firms are leading innovation with multiple startups and established players receiving government and VC funding to expand non-reactor-based production.

Conclusion:

The global molybdenum-99 market is both critical and fragile but evolving. With a growing shift toward secure, sustainable, non-reactor-based production, the next 5–10 years will redefine how this essential isotope is made and distributed.

Whether you're a healthcare provider, policy maker, or nuclear tech investor, understanding molybdenum-99 supply chains and innovations is no longer optional it’s urgent.

About Us:

StraitsResearch.com is a leading research and intelligence organization, specializing in research, analytics, and advisory services, along with providing business insights & research reports.

Contact Us:

email: sales@straitsresearch.com

Website: https://straitsresearch.com/