As a packaging industry analyst with over 10 years of experience in industrial automation and supply chain trends, I’ve closely tracked the rise of corrugated packaging and the critical role corrugated box making machines play in meeting demand.

Core insight up front:

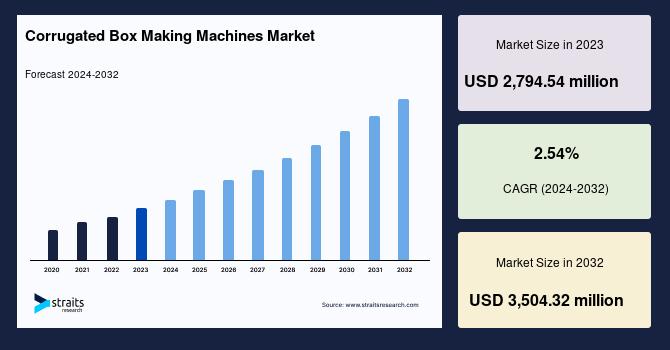

The global corrugated box-making machines market size was valued at USD 2,794.54 million in 2023. It is estimated to reach USD 3,504.32 million by 2032, growing at a CAGR of 2.54% during the forecast period (2024–2032).

What is a corrugated box making machine?

Corrugated box making machines are industrial systems used to produce custom and standard-sized corrugated boxes. They are used by packaging converters, logistics companies, and manufacturers across multiple industries.

Key machine types:

-

Flexo folder gluers

-

Rotary die cutters

-

Automatic box slotters

-

Inline printing and slotting machines

-

Digital box making machines for short runs and on-demand packaging

Why is demand for corrugated box making machines growing?

The demand is closely linked to two main drivers:

1. E-commerce boom

Retailers are shipping more products direct-to-consumer, requiring more custom-sized corrugated boxes, produced in smaller batches.

2. Sustainability push

Corrugated board is recyclable, biodegradable, and increasingly favored over plastic. This aligns with corporate ESG goals and government regulations.

Other contributors:

-

Rising industrial output

-

Rapid urbanization and warehousing

-

Need for cost-efficient, right-sized packaging to reduce shipping waste

Request a sample report @ https://straitsresearch.com/report/corrugated-box-making-machines-market/request-sample

Market segmentation: How is the market structured?

| Segment | Detail |

|---|---|

| By Machine Type | Automatic, Semi-Automatic, Manual |

| By Box Type | Slotted Boxes, Die-Cut Boxes |

| By End-Use Industry | E-commerce, Food & Beverage, FMCG, Electronics, Logistics |

| By Region | Asia-Pacific, North America, Europe, Latin America |

Top Growth Region:

Asia-Pacific leads, driven by China and India, thanks to their booming manufacturing and packaging sectors.

Who are the top manufacturers of corrugated box making machines?

Global Leaders:

-

Bobst Group (Switzerland)

-

Fosber Group (Italy)

-

Boxmat (Poland)

-

EMBA Machinery (Sweden)

-

Dongguang Ruichang Carton Machinery (China)

-

Zemat Technology Group

These companies offer advanced features like:

-

AI-driven box dimensioning

-

Inline digital printing

-

Tool-less changeover systems

-

IoT-connected diagnostics

What are the key trends shaping the market?

Digital transformation

Short-run packaging and personalized box printing are pushing demand for digital corrugated box making machines with quick changeover and minimal downtime.

On-demand packaging

Warehouses and 3PLs are adopting compact machines to produce right-size boxes instantly, reducing void fill and shipping costs.

Automation & robotics

Full automation from board feeding to folding and gluing is helping manufacturers boost speed, accuracy, and labor efficiency.

What challenges does the market face?

-

High upfront investment for fully automated systems

-

Maintenance complexity of high-speed, multi-function machines

-

Skill gap in operating advanced digital packaging systems

-

Fluctuating raw material costs impacting ROI for converters

Corrugated Box Making Machines Market Outlook (2025–2030)

| Year | Market Size (USD Billion) |

|---|---|

| 2025 | 3.1 |

| 2026 | 3.3 |

| 2027 | 3.5 |

| 2028 | 3.7 |

| 2029 | 3.9 |

| 2030 | 4.1 |

The shift toward customization, speed, and sustainability will continue to fuel innovation and investment in this segment.

FAQs: Corrugated Box Making Machines

1. How much does a corrugated box making machine cost?

Prices range from $20,000 for basic semi-automatic machines to $2 million+ for fully automated, inline systems with printing and die-cutting.

2. Which machine is best for small batch or on-demand packaging?

Digital corrugated box making machines are ideal for short runs, custom boxes, and variable printing.

3. Is it profitable to invest in a box making machine?

Yes, especially for companies that need custom box production, lower packaging costs, or are looking to offer packaging as a service (PAAS).

4. How long is the payback period?

Typical ROI is 2–4 years, depending on machine capacity, automation level, and volume of output.

5. Can one machine make different box sizes?

Most modern machines come with automatic or semi-automatic adjustment for multiple box sizes and formats.

6. What materials are compatible with these machines?

Corrugated box machines typically handle single-wall and double-wall corrugated sheets, with varying flute sizes.

7. What industries are the biggest users of box making machines?

-

E-commerce and retail

-

Food and beverage

-

Consumer electronics

-

Pharmaceuticals

-

Logistics and fulfillment centers

Conclusion:

The corrugated box making machines market is on a solid growth path, driven by automation, sustainability, and packaging efficiency. Manufacturers investing in smart, flexible, and digital machines are well-positioned to meet the evolving needs of global packaging demands.

Would you like a tailored comparison of machine models or manufacturers by region? Let me know your use case.

About Us:

StraitsResearch.com is a leading research and intelligence organization, specializing in research, analytics, and advisory services, along with providing business insights & research reports.

Contact Us:

email: sales@straitsresearch.com

Website: https://straitsresearch.com/