Cloud hosting of tax software essentially means running your favorite desktop-based tax applications on secure cloud servers. In other words, the software is installed on remote servers by a special cloud service provider instead of being installed locally on a computer. The user can access the tax programs and data from anywhere, be it from the office, home, or even on the way, through an internet connection.

This setup will eliminate all hardware limitations, letting multiple users work in the same workstation simultaneously, which is ideal for accounting firms, CPAs, and tax professionals that experience high volumes of work during the busy tax season.

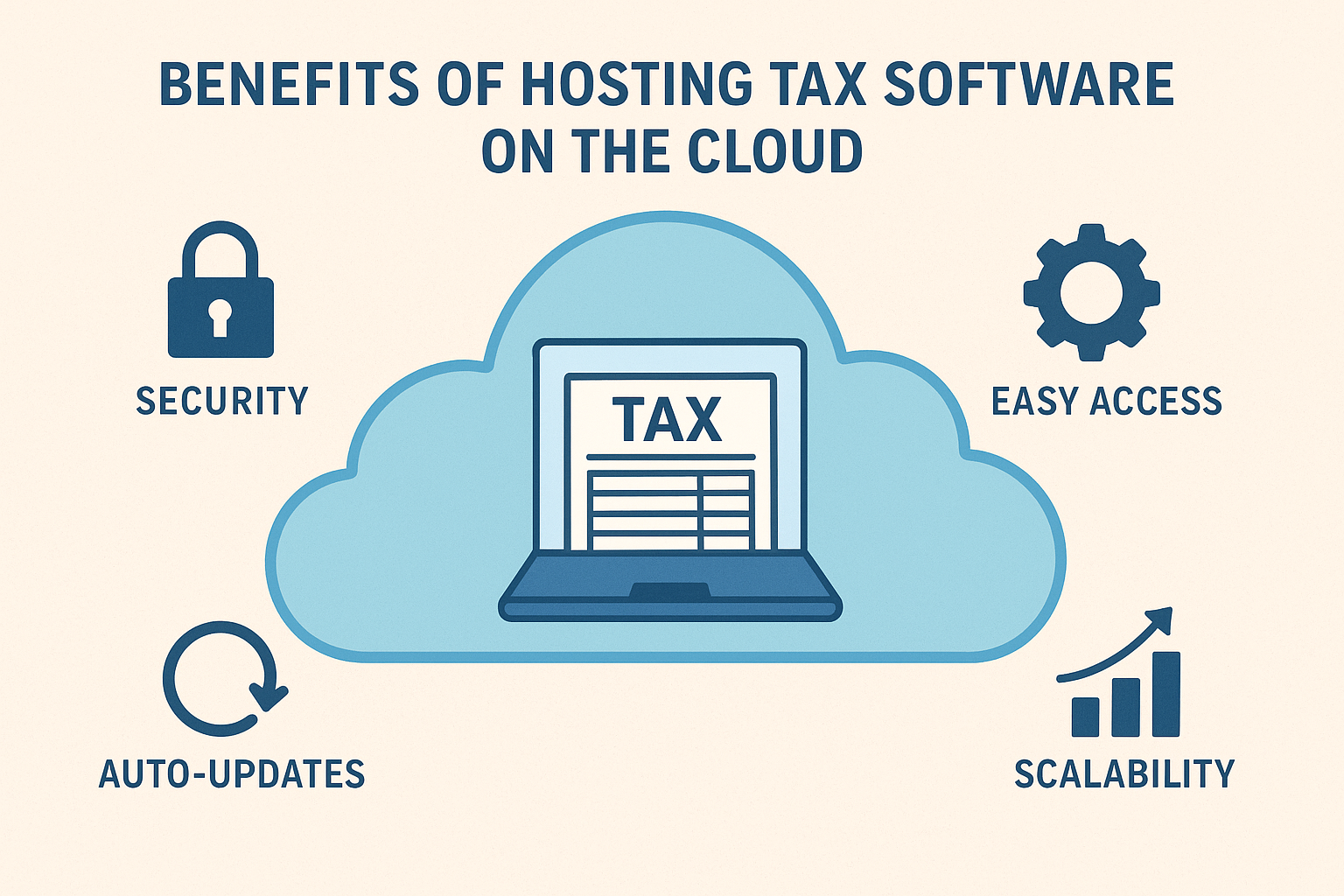

⚙️ Key Benefits of Cloud-Based Tax Software Hosting

1️⃣ Accessibility Anywhere, Anytime

The biggest advantage of hosting tax software on the cloud is remote accessibility. Accountants and staff can log in securely from any device-desktop, tablet, or smartphone-without compromising performance or data security.

2️⃣ Improved Data Security

It employs bank-grade encryption, multi-factor authentication, and continuous backups so that your tax data is protected from breaches or data loss. Hosting solutions for Drake Tax Software Hosting and UltraTax CS Hosting use advanced firewalls and 24/7 monitoring for maximum protection.

3️⃣ Seamless Collaboration

Multiple team members can work on the same client file simultaneously. This real-time collaboration makes the workflow smooth, helps to avoid version conflicts, and makes sure that everyone is always working on the most updated information.

4️⃣ Scalability and Flexibility

Whether you're a small tax practice or a large accounting firm, Tax Software Hosting on Cloud scales easily. Adding users or storage space is instantaneous during the tax season without additional investment in hardware.

5️⃣ Reduced IT costs

Cloud hosting will save you from costly servers and in-house IT management. All the maintenance, updates, and backups are done by the provider, freeing your team to focus solely on client services and productivity.

☁️ Drake Tax Software Hosting: Simplify Your Workflow

Drake Tax Software Hosting brings the power of popular Drake desktop software to the cloud. Hosted Drake offers users the very same features, interface, and tools but with added mobility, reliability, and security.

Key Features:

- Real-time multi-user access for accountants and staff

- Automated daily backups to prevent data loss.

- 99.99% uptime, powered by premium cloud infrastructure

- Bank-level data security and compliance with IRS standards

Hosting Drake Software on the cloud means your firm can work anywhere, collaborate with ease, and still make filing deadlines without delays.

UltraTax CS Hosting: The Future-Ready Solution for Tax Professionals

UltraTax CS hosting is another great example of how the cloud makes complex tax workflows simple. Hosting UltraTax CS on the cloud enables firms to integrate that with other Thomson Reuters CS applications for a connected and efficient ecosystem.

Advantages of UltraTax CS Hosting:

- Secure access to client files 24/7

- Quick updates and automatic maintenance handled by the provider.

- Increased speed and performance during peak tax season

- Full compatibility with Windows and Mac devices

UltraTax CS hosting combines with other CS Suite tools to help tax firms reduce workloads, enhance turnaround times, and ensure that every return filed is highly accurate.

Why Choose Tax Software Hosting on Cloud?

Cloud hosting is not a technological trend; it's the backbone of modern tax management. A combination of Drake Tax Software Hosting, UltraTax CS Hosting, and other leading tax applications over the cloud creates a dynamic environment for growth and efficiency.

Top Reasons to Move to the Cloud:

- Ensure data protection for clients and compliance

- Greater uptimes and reliability for critical tax operations

- Smooth collaboration between distributed teams

- Quick disaster recovery and minimal downtime

- Cost-efficient and eco-friendly IT management

☝️ Final Thoughts

The accounting world is changing fast, and adapting to Tax Software Hosting is no longer an option but a requirement for any firm seeking agility, security, and efficiency. Whether you prefer Drake Tax Software Hosting or UltraTax CS Hosting, migrating on a cloud-based platform ensures your firm stays ahead in the competitive race while delivering the best client experience. Cloud hosting is an investment in the future of your firm. With scalable infrastructure, secure access, and expert technical support, your team will be empowered to do what really matters most: preparing taxes accurately, satisfying clients, and facilitating business growth.

Frequently Asked Questions

1. What is Tax Software Hosting on the Cloud?

Answer: Tax Software Hosting on Cloud means running your desktop-based tax applications—like Drake or UltraTax CS—on secure cloud servers managed by a hosting provider. Instead of being limited to one computer, users can access their tax software anytime, anywhere, through an internet connection. It allows multi-user collaboration, automatic backups, and enhanced data security, making it perfect for tax professionals and accounting firms.

2. Why should accounting firms choose Drake Tax Software Hosting?

Answer: Drake Tax Software Hosting offers unmatched convenience and performance for accounting firms. By hosting Drake on the cloud, users get real-time access to data, faster file processing, and improved team collaboration. It also ensures bank-level encryption, automated data backups, and 99.99% uptime. Firms can reduce IT costs while maintaining a secure and flexible work environment.

3. How does UltraTax CS Hosting improve tax preparation efficiency?

Answer: UltraTax CS Hosting enhances efficiency by allowing multiple users to access and work on the same client files simultaneously. It offers seamless integration with other Thomson Reuters applications, enabling a unified workflow. Hosting UltraTax CS on the cloud ensures faster processing, easy scalability during tax season, and automatic updates—helping tax professionals meet deadlines with confidence.

4. Is Tax Software Hosting on Cloud secure for sensitive client data?

Answer: Absolutely. Tax Software Hosting on Cloud providers use enterprise-grade security protocols such as SSL encryption, firewalls, multi-factor authentication, and intrusion detection systems. Data is stored in SSAE-18 compliant data centers with daily automated backups and disaster recovery options. These measures ensure client information stays protected from unauthorized access or data loss.

5. How do I choose the best hosting provider for my tax software?

Answer: When selecting a provider for Tax Software Hosting on Cloud, consider factors such as uptime reliability, data security measures, 24/7 technical support, and scalability. Choose a provider that offers specialized hosting for Drake Tax Software Hosting and UltraTax CS Hosting, ensuring smooth software performance and full compatibility. Always verify their compliance certifications and customer support reputation before committing.

Also, visit here: https://blogs.arzuka.com/10-powerful-benefits-of-lacerte-tax-software-hosting-for-accounting-firms-in-2025/